New GST Rates – GST 2.0: Everyday Items Set To Become Cheaper

India’s tax system is about to go through a big change that could leave more money in your pocket. The GST Council has cleared a new, simpler tax structure that takes effect from September 22, 2025. With lower rates on groceries, electronics, and even insurance, this reform is being seen as one of the most consumer-friendly steps in recent years.

What’s New With GST?

The Goods and Services Tax (GST) is getting a major update, now being called GST 2.0. Prime Minister Narendra Modi announced it during his Independence Day address, calling it a move that will make life easier for people. The 56th GST Council meeting in New Delhi on September 3-4, 2025, finalized the reforms. The timing is perfect, as the changes will start just ahead of the festive season.

Major Rate Changes

The old four-slab system (5%, 12%, 18%, 28%) is being cut down to two main slabs. Essentials will be taxed at 5%, and standard goods at 18%. A new 40% slab will cover products considered “sin goods,” like tobacco and luxury items.

Here’s what becomes cheaper from September 22:

- Daily Essentials: Shampoo, toothpaste, hair oil, soaps, and namkeens move down to 5% from 12% or 18%.

- Food Items: UHT milk, paneer, and Indian breads like roti and paratha will now be completely tax-free. Butter, ghee, and dry fruits such as almonds and cashews shift to 5%.

- Electronics: TVs, air conditioners, and dishwashers drop from 28% to 18%.

- Healthcare: Life and health insurance premiums become GST-free. Medical devices including thermometers and glucometers fall to 5%.

- Agriculture: Fertilizers, drip irrigation systems, and tractor parts move to 5%.

- Education: Stationery like pencils, notebooks, and maps will now be tax-free.

What Stays Expensive?

Not everything will see a price cut. Goods such as cigarettes, gutka, and sugary drinks fall under the new 40% slab. They will also be taxed on the basis of Retail Sale Price (RSP), which is aimed at stricter tracking and compliance.

Why This Matters To You

These cuts are designed to reduce everyday expenses:

- Groceries: Lower GST on packaged food and dairy means your monthly bills will drop.

- Big Purchases: Buying a TV or AC will cost less with the reduced 18% rate.

- Insurance: With no GST on health and life insurance, households will see clear savings.

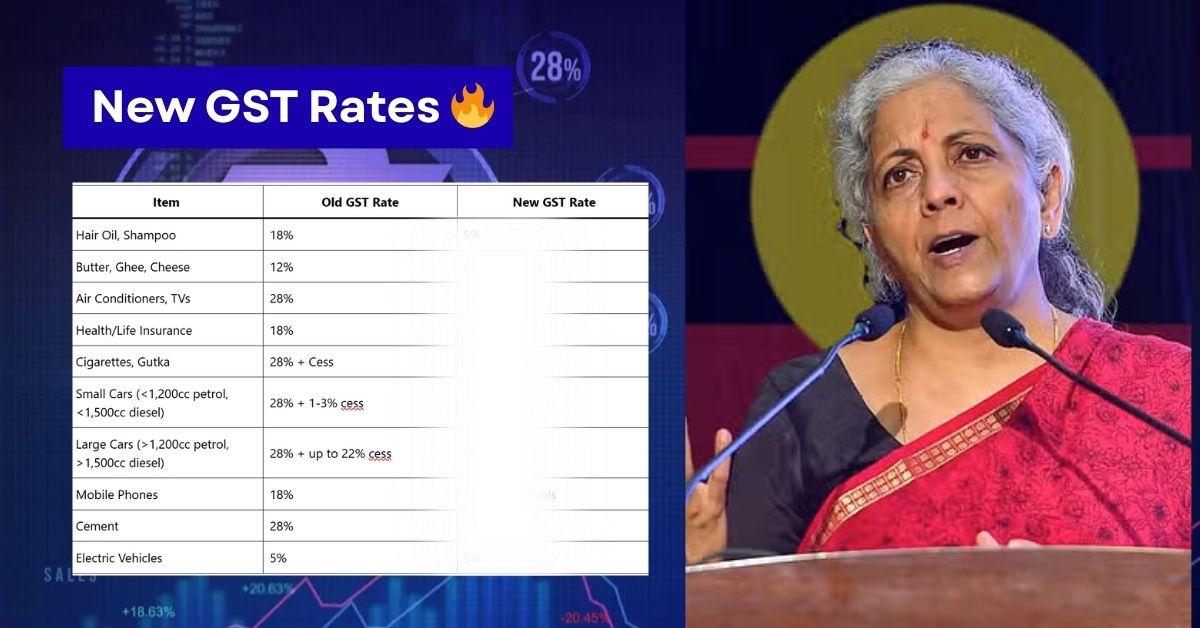

Snapshot Of Rate Changes

| Item | Old GST Rate | New GST Rate |

|---|---|---|

| Hair Oil, Shampoo | 18% | 5% |

| Butter, Ghee, Cheese | 12% | 5% |

| Air Conditioners, TVs | 28% | 18% |

| Health/Life Insurance | 18% | 0% |

| Cigarettes, Gutka | 28% + Cess | 40% + Cess |

| Small Cars (<1,200cc petrol, <1,500cc diesel) | 28% + 1-3% cess | 18% |

| Large Cars (>1,200cc petrol, >1,500cc diesel) | 28% + up to 22% cess | 40% |

| Mobile Phones | 18% | 5% Most Models |

| Cement | 28% | 18% |

| Electric Vehicles | 5% | 5% |

Public Reactions

On X, the response has been mostly positive. Many middle-class families are welcoming the move, especially the cuts on electronics and insurance. A user named @nehanagarr called it a “game-changer.” On the other hand, some like @mainbhiengineer raised concerns about smooth implementation, pointing to issues faced with earlier tax policies. Opposition-led states also flagged worries about revenue loss, but the GST Council maintains that the new structure is financially balanced.

What Lies Ahead

The government has also signaled that the compensation cess will be removed by March 2026. Along with that, new tech-driven features like pre-filled returns and faster refunds are on the way. For businesses, compliance should become easier, and for consumers, shopping during the festive season could feel lighter on the budget.

Final Take

GST 2.0 is being seen as a bold step that combines affordability with simplicity. Whether you are buying essentials, upgrading your home with appliances, or securing your family through insurance, these changes can help you save. Watch out for September 22, when the new rates come into play, and see how much of a difference it makes in your day-to-day spending.