SBI FD Scheme 2025: Big Changes in Interest Rates – What You Need to Know

Looking For A Safe Place To Park Your Money In 2025? SBI has brought some updates that might interest you. The country’s largest bank has rolled out new fixed deposit schemes with decent rates. But there is one catch — some rates have recently gone down.

Here’s a complete look at SBI’s FD schemes for 2025, including the new offers you should know about.

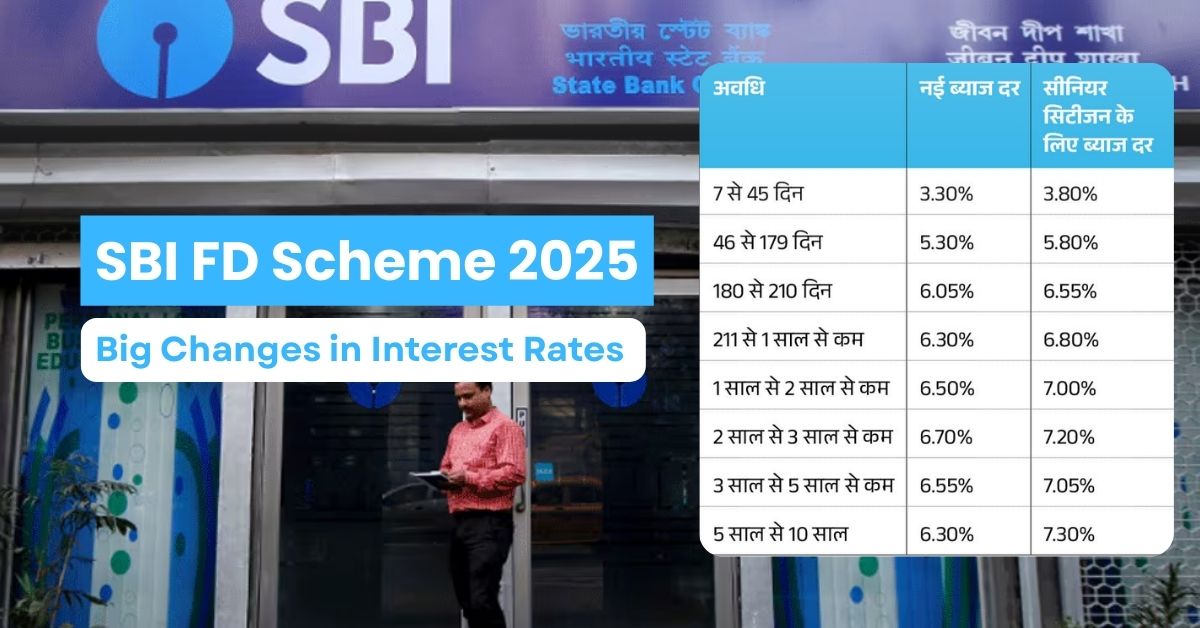

What’s New In SBI FD Rates 2025

For regular depositors, SBI’s fixed deposit rates now range between 3.30% and 6.85% depending on the tenure you choose. These numbers have shifted this year mainly because of RBI’s policy changes.

Key Current Rates:

- General public: 3.30% to 6.85% annually

- Senior citizens: 3.80% to 7.35% annually

- Super senior citizens (80+): Up to 7.60% annually

In May 2025, SBI reduced rates by 20 basis points after RBI trimmed the repo rate. So a scheme that earlier offered 7.05% now gives 6.85%.

SBI’s Star Product: Amrit Vrishti FD

The 444-day Amrit Vrishti scheme is still SBI’s most popular option. First launched in July 2024, the bank has extended it until March 31, 2026.

Current Amrit Vrishti Rates:

- General public: 6.85%

- Senior citizens: 7.35%

- Super senior citizens: 7.45%

Example Calculation:

A deposit of ₹1,00,000 in Amrit Vrishti earns:

- Regular depositor: ₹8,343 interest

- Senior citizen: ₹8,955 interest

- Super senior: ₹9,077 interest

Other SBI Schemes Worth Checking

- SBI Patrons (For 80+ Customers)

Introduced in Jan 2025. Offers 10 basis points extra over senior citizen rates. - SBI Green Rupee Term Deposit

- Supports eco-friendly projects

- Tenures: 1111, 1777, 2222 days

- Rate: 10 basis points lower than standard FDs

- Tax Saving FD

- 5-year lock-in period

- Rate: 6.50% (general), 7.50% (seniors)

- Tax benefit up to ₹1.5 lakh under Section 80C

- Multi Option Deposit (MODS)

- Withdraw in multiples of ₹1,000

- Remaining balance continues to earn FD interest

- Minimum deposit: ₹10,000

What Customers Say About SBI FDs

The Positives:

- SBI remains a trusted government-backed bank

- Digital banking through YONO app is smooth

- Senior citizen perks add value

- Deposits insured up to ₹5 lakh

The Concerns:

- Rate cuts have upset many savers

- Central Bank offers 7.85% for 444 days

- Some private banks provide even higher rates

- Premature withdrawal penalty between 0.5% and 1%

SBI FD Vs Other Banks

| Bank | 444-Day Rate (General) | Senior Rate |

|---|---|---|

| SBI | 6.85% | 7.35% |

| Central Bank Of India | 7.85% | 8.35% |

| Bank Of India | Up To 8.85% | Higher |

| IndusInd Bank | 7.00% | 7.50% |

Tips Before You Invest

- Check if you qualify for senior or super senior benefits

- If 80+, look at the SBI Patrons scheme

- Compare with other banks to maximize returns

- Remember loan facility is available up to 90% of FD value

Tax Points:

- Interest above ₹40,000 attracts 10% TDS

- Seniors get a higher ₹50,000 exemption

- Submit Form 15G/H to avoid TDS if your income is low

Digital Options:

- Open FD through the YONO app or SBI Net Banking

- Branch support available if needed

Should You Pick SBI FD Now?

SBI FDs are still a good choice if you want:

- Complete safety of funds

- Assured returns without market risks

- Steady income through interest payouts

- Easy loan access against deposits

But if maximum returns is your goal, compare with smaller banks and NBFCs, some of which are offering up to 8.4% for similar durations.

Final Word

SBI’s FD schemes in 2025 offer stability and security, though recent cuts have reduced the appeal for some. The Amrit Vrishti scheme continues to stand out, especially for seniors who can earn up to 7.45%.

If you are planning to invest, keep an eye on scheme deadlines and always confirm the latest rates on SBI’s official site, since RBI policies can bring changes at any time.